Losing Streak and Win-Ratio

Most of us as traders have the urge to ensure that the current trade should not end up being a loser and consciously or unconsciously, we make efforts towards this end. We either adjust the stop loss or exit trades at breakeven or do something else.

The other common problem a trader faces is the hesitation to take the next trade after a string of losing trades. A string or series of losing trades is also called a losing sequence.

A lot of traders are not even aware that they are affected by these two problems and end up making the same mistake time and again and end up losing the capital and/or take undue stress in trading.

The easy way to address this is to do a thorough back-testing of your system and also realize the probability of losing streak or losing sequence based on your system parameters.

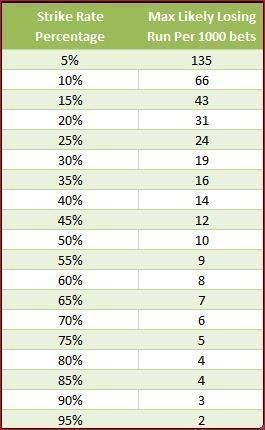

Have a look at the table below which summarises the chances of a losing streak based on 1000 trades.

There are a few important takeaways from that table. The important point is losing trades are unavoidable as there is no system that has a 100% win-ratio. The other important point is that the number of losing trades or the length of the losing streak is dependent on your system’s win-ratio.

If you are a trend follower, then by default your win-ratio will be a smaller number which means that your losing trades and the losing streak will be bigger.

For example, if your system has a win ratio of 40% (which is not bad at all), then you can expect up to 14 consecutive losing trades. So, understand your system and you will be mentally prepared to encounter those losing streaks and have the confidence to take the next trade.

Once you realize this, you will also not have the urge to make sure that the current trade does not end up being a losing one. You will realize that losing trades are inevitable and what is more important is to stick to the system parameters.

If you find the content useful, do let us know and we can discuss more related concepts in the upcoming newsletters.

Founder - Market Mantra99